TSX-V: SAO

Kelowna, British Columbia, February 16th, 2021 – SOUTH ATLANTIC GOLD INC. (TSX-V: SAO) (“South Atlantic” or the “Company”) is pleased to announce that all drill hole core sample results have been received for the historic drilling validation program. The validation of historic drilling results represents a very important milestone for the Company as these results can now be incorporated into the NI 43-101 document currently being prepared as part of the earn-in with Jaguar Mining Inc. (“Jaguar Mining”).

Highlights:

- All historic drill intercepts, representing over 784.25 meters (“m”) of drill core, collected by previous operators have successfully been validated.

- Several high-impact historic results from the Coelhos-Queimadas Target validated as part of this program include8 meters (“m”) of 7.38 grams per tonne (“g/t”) gold (“Au”) at (FCC002), 12.85m of 5.23 g/t Au (FCC016) and 0.95m of 5.35 g/t Au at (FCW006), all of which are being incorporated in a geological model (click to see map at SouthAtlanticGold.com).

- Additional drill results from the Coelhos-Queimadas Target, including several step-out drill holes, were completed during this phase of work with assays pending.

Douglas Meirelles, CEO and Director stated “We are very pleased with the completion of this milestone with results that have exceeded our expectations. We have now accomplished yet another step in our on-going exploration at Pedra Branca. Our team is systematically checking the boxes as outlined in the Phase I Exploration Program. We look forward to the completion of the next catalyst at the Pedra Branca project: the completion of the expenditures required by the earn-in agreement with Jaguar Mining.”

Marcelo Batelochi, Senior Exploration Manager stated “The validation of the historical drilling was a challenging but necessary process. With the validation completed, we can now focus on our geologic and resource modeling. We remain on track to complete the Phase I Exploration program on-time and on-budget, with the goal remaining to ultimately define a mineral resource at the Pedra Branca Project.”

HISTORIC DRILLING OVERVIEW

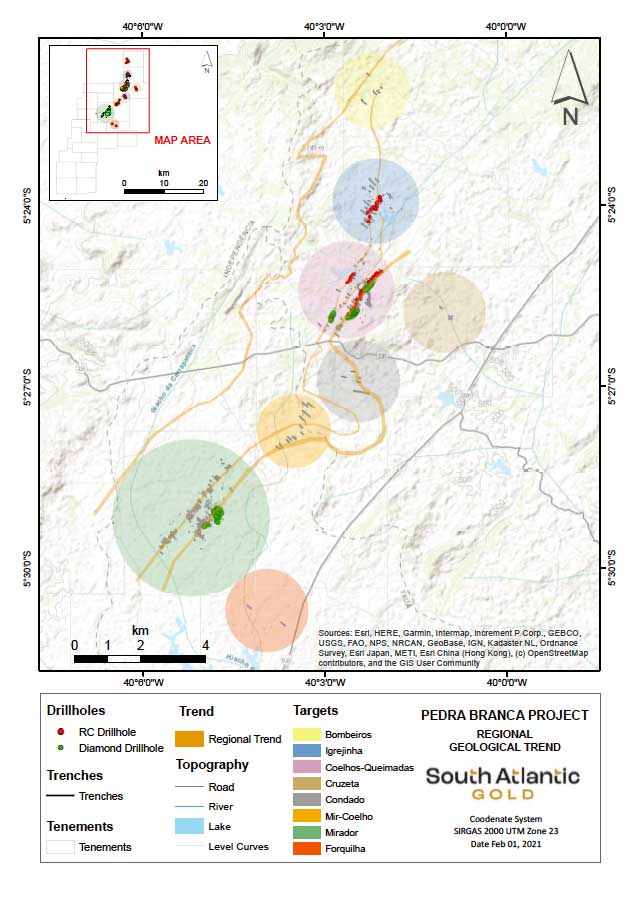

Historical exploration at Pedra Branca first commenced in 1986 by Unamgen (formerly Gencor) and consisted of airborne geophysics, regional geochemistry (stream sediment sampling), geological mapping, trenching and channel sampling which led to the identification of three exploration targets: Coelho, Queimadas and Mirador. Noranda/Falconbridge/Xstrata sporadically explored Pedra Branca until Jaguar Mining acquired the tenements in 2007 and conducted further exploration until 2011 (ref. Figure 1). South Atlantic acquired the tenements from Jaguar Mining in 2020 and commenced its Phase 1 Exploration Program in November 2020.

One element of the Phase 1 Exploration Program consisted of database validation and consolidation to ensure that results from the historic exploration work programs (specifically drill results from Jaguar Mining) were validated through the re-assay process, which was successfully completed.

(Figure 1 – 20km Regional Trend) Click here to enlarge mapEXPLORATION PROGRAM UPDATE

The current exploration program at Pedra Branca has been completed in line with the recommendations in the Phase 1 Exploration Program outlined in the “Technical Report, Geology, Mineralization and Exploration of the Pedra Branca Gold Project, Ceará State, Northeastern Brazil” dated August 21st, 2020 and filed on www.sedar under the Company’s profile.

The main milestones for the Company’s work program at Pedra Branca are outlined below:

- Established Brazil Operations & Mobilized Team (Completed)

- Drill Program Commenced (Completed)

- Initial Trench Results (Completed)

- Initial RC Drilling Results (Completed)

- Historical Diamond Drilling Holes Validation. (Completed)

- Complete Exploration Program and Earn-In (On-Going)

- Resource Modeling (On-Going)

The Company remains on-time and on-budget to complete the entire Phase I Exploration Program. Exploration expenditures are progressing toward the earn-in agreement with Jaguar Mining. All exploration results are being consolidated into its geological database.

The three main targets that are under the mining concession process with The Brazilian Mining Agency (“Agencia Nacional de Mineração” or “ANM”) include Igrejinha, Coelhos-Queimadas and Mirador North/South. Thus far, the new and historical results consolidated from Igrejinha and Coelhos-Queimadas are highlighted as follows:

Igrejinha Target

Two new trenching discoveries were made at the Igrejinha Target which include a 29 m intersection grading 0.73 g/t Au which includes a 4 m intersection grading 3.22 g/t Au, and a second intersection of 10 m grading 3.99 g/t Au (including 1 m grading 31.0 g/t Au). In addition, two main mineralized trends have been identified to date (click here to see Igrejinha map).

Exploration Phase 1 work at Igrejinha is on-going and is expected to conclude by Q1 2021. Results will integrate the geological model and are inclusive of:

- PB-RC-001A: 1.00m @ 5.56 g/t Au (From 24m)

- PB-RC-002: 1.00m @ 5.90 g/t Au (From 22m)

- PB-RC-003A: 1.00m @ 2.59 g/t Au (From 7m)

- PB-TR-006: 4.00m @ 3.22 g/t Au (Trench sample at surface)

- PB-TR-009: 6.00m @ 7.19 g/t Au (Trench sample at surface)

- PB-RC-007: 1.00m @ 2.37 g/t Au (From 3m)

Coelhos-Queimadas Target

The Coelhos-Queimadas Target is well defined by historic drill hole intercepts and surface trenches. This target is characterized by two parallel zones of mineralization, each approximately 500 m in length and approximately 6 m wide located along a northeasterly trend. Gold mineralization has currently been intersected by historic drilling to a depth of 80 m and currently remains open both at depth and along strike.

Six select intersections from Historical Diamond Drilling at the Coelhos-Queimadas Target (click here to see Coelhos-Queimadas map) included:

- FCC002: 12.80m @ 7.38 g/t Au (From 46.3m)

- FCC003: 5.90m @ 3.56 g/t Au (From 49.1m)

- FCC016: 12.85m @ 5.23 g/t Au (From 90.2m)

- FCC020: 2.00m @ 3.43 g/t Au (From 153.8m)

- FCQ001: 2.05m @ 3.56 g/t Au (From 49.45m)

- FCW006: 0.95m @ 5.35 g/t Au (From 9.9m)

These intersections are located along the main mineralized trend (except for drill hole FCW006 which is located to the west and occur along subparallel intra‐foliated millimetric/centimetric strings of sulfides in amphibolite schists with variable magnetite, pyrite and pyrrhotite.

The Company expects to receive further assay results from the Igrejinha, Coelhos-Queimadas and Mirador targets and will incorporate these into its geological model. Further exploration work in the remaining tenements continue and will allow the Company to maintain our permits in compliance with the ANM.

PEDRA BRANCA LICENSES & PERMITS UPDATE

On January 26th, 2021, ANM published its Ordinance n. 55/2021 in the Official Gazette. This new rule amended Ordinances 28 and 46/2020, which dealt with the extension of the term for mineral titles as well as the suspension of all procedural and material deadline requirements. The suspension period is now extended to June 30th, 2021. Therefore, the extension went up from 288 days to 467 days. (click here to see tenement map).

QA/QC PROCEDURES

The results of the historical drilling re-assays follow Quality Assurance/Quality Control (QA/QC) procedures that included the insertion of standards, blanks and duplicate samples, sent to the lab along with the quarter (1/4) core samples. A total of 811 core intervals (entire mineralized diamond drilling cores) were resampled with the inclusion of 34 duplicate samples (4%), 36 blank samples (4%) and 33 standard samples (4%) for a total of 914 samples.

All samples, aside from the ¼ core samples above, are cataloged and organized in the core shed at the Pedra Branca Project, in which 1 control sample has been sent out for every 10 samples sent to the laboratory (3.3% Standards; 3.3% Duplicates; 3.3% Blanks).

All samples were analyzed at either SGS GEOSOL Laboratórios Ltda in Minas Gerais, Brazil, or ALS Brasil Limitada in Minas Gerais, Brazil. Both contracted laboratories follow the same procedures for sample preparation and chemical analysis, described below. In the laboratory, each ±2 kg sample is recorded, dried for 8 to 12 hours, crushed to 70% <2mm (-10 #) split to obtain approximately 250g and the 250g sub-samples are pulverized to P85 74 microns (-200 #).

Gold analysis is carried out using fire assay comprising three stages: Fusion, Cupellation and Analysis.

Samples with a gold fire assay equal to or higher than 10.0 g/t Au are re-analyzed by a screen-metallic method. Base metal assays are first determined by ICP-OES (Inductive Coupled Plasma-Optical Emission Spectroscopy). Analyses of ore elements that exceed the method’s upper limits are re-analyzed by appropriate ore-grade methods.

About South Atlantic Gold

South Atlantic Gold is an exploration company engaged in acquiring and advancing mineral properties located in the Americas. The Company’s principal BC asset is the wholly-owned 4,056-hectare Big Kidd property, located near Aspen Grove, BC. Our Brazilian flagship asset is our option to acquire the Pedra Branca project, located 280 km southwest of Fortaleza, Ceara State, Brazil. South Atlantic Gold is focused on creating value for its shareholders by engaging in the development and acquisition of high-quality mineral assets located in stable and mining friendly jurisdictions. South Atlantic Gold’s is based in Kelowna, British Columbia, and is listed on the TSX-V under the symbol “SAO.

ON BEHALF OF THE BOARD

Douglas Meirelles, President and CEO

For more information regarding this news release, please contact:

Douglas Meirelles, President and CEO

Anne Hite, Vice President, Investor Relations

T: 250-762-5777

Email: ir@southatlanticgold.com

Qualified Person

The scientific and technical information that forms the basis for parts of this press release was reviewed and approved by Marcelo Antonio Batelochi (P.Geo.), MAUSIMM (CP), the Company’s Exploration Manager who is a Qualified Person “(QP”) as defined by National Instrument 43-101.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking Information”, as such term is used in applicable Canadian securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. There can be no assurance that the Fundamental Acquisition will be completed as proposed or at all.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company’s expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company’s public disclosure documents filed on the SEDAR website at www.sedar.com.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.