TSX-V: SAO

Kelowna, British Columbia, June 28, 2021 – SOUTH ATLANTIC GOLD INC. (TSX-V: SAO) (“South Atlantic” or the “Company”) is pleased to report that Pedra Branca’s Maiden Resource has been completed and is presented under National Instrument (“NI”) 43-101 technical report standards. The resource was completed by the consolidation of historical drilling and Phase 1 Reverse Circulation (“RC”) drilling results with an average depth of 41.2 meters (“m”).

Highlights

- Completed 100% earn-in of the Pedra Branca Project (“Pedra Branca” or the “Project”) from Jaguar Mining Inc. (“Jaguar”) through the delivery of the NI 43-101-compliant technical report.

- Maiden mineral resource:

- A total of 10,523 samples were included in the resource calculation before the cut-off date of February 19th, 2021. As such, all remaining 8,188 (43% additional samples) were not included in the resource and are considered only as exploration results.

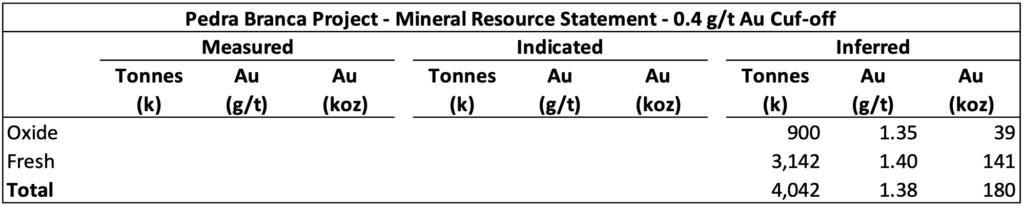

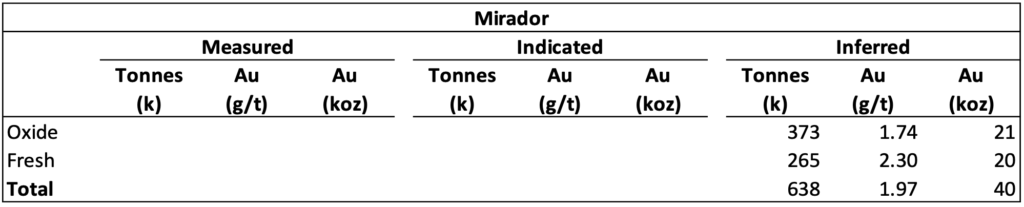

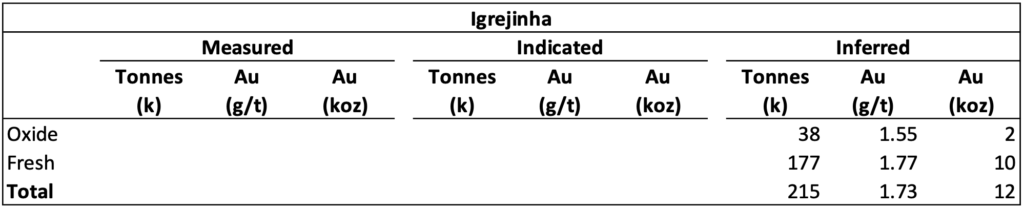

- Inferred mineral resource includes (click here for complete inferred resource tables):

- Oxide: 900,000 tonnes (“t”) grading 1.35 grams per tonne (“g/t”) gold (“Au”) for 39,000 oz Au

- Fresh: 3,142,000 t grading 1.40 g/t Au for 141,000 oz Au

- Total: 4,042,000 t grading 1.38 g/t Au for 180,000 oz Au

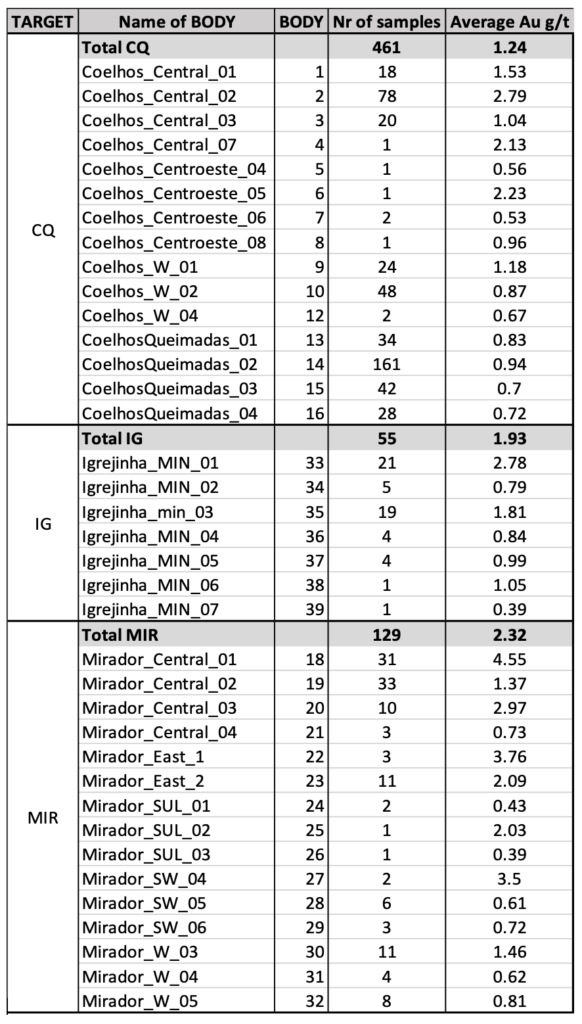

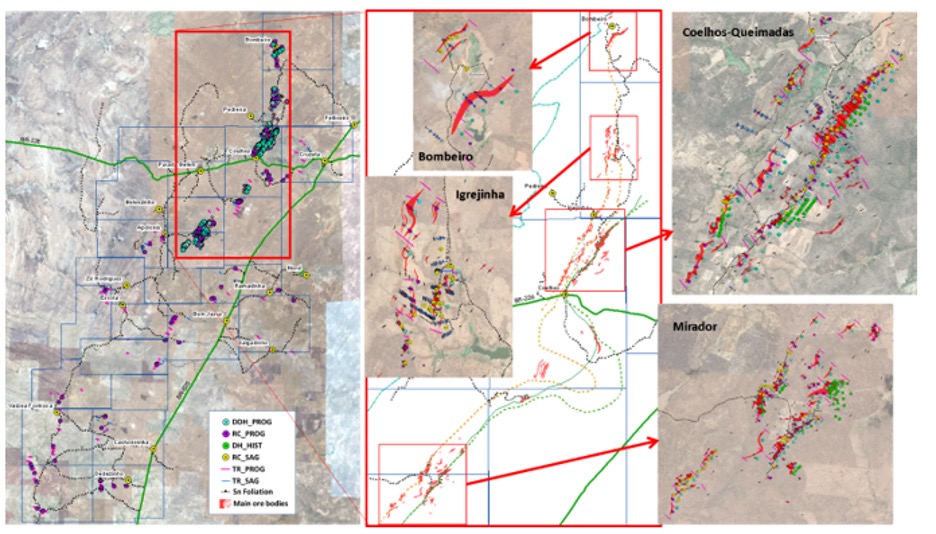

- Over 39 mineralized N20E/40SE zones were individualized, along a 12km strike length with an average thickness of 4 m, over the 3 main targets: Igrejinha, Coelhos-Queimadas and Mirador (click here for table of ore grades at these Targets).

- The Phase I RC drilling was completed to an average depth of 41.2 m. From the historical drilling, higher grades have been reported from deeper intercepts with a total of 93 historical Diamond Drilling (“DD”) holes also included in the maiden resource calculation.

Douglas Meirelles, CEO stated, “The primary objective of this technical report was to provide a NI 43-101-compliant report to Jaguar Mining Inc. (“Jaguar”) in order to complete our additional 25% earn-in to attain full ownership of the Pedra Branca Project. As such, our focus was to deliver a maiden resource report as quickly as possible during our Phase I exploration program. A cut-off date for the resource calculation was set at February 28th, 2021 in order to enable sufficient time to complete the report and have Jaguar review prior to mid-2021.

Our team was very successful, and with a USD 1 million exploration program, defining a total of 39 mineralized zones along the entire 12 km mineralized trend. Going forward, the Phase II program will be designed to further delineate and possibly bridge the gaps between the mineralized areas and transition the current resource to an advanced stage asset as set by the mining concession issued by the National Mining Agency of Brazil.”

The company will work with Jaguar to complete the required government processes to transfer the Pedra Branca asset to South Atlantic Gold’s subsidiary in Brazil.

The Company is also pleased to report that an additional tenement located in the center of the Project was recently acquired. This new tenement increases the Pedra Branca land area to 39,906 hectares. The location and acquisition of this new tenement was deemed essential to consolidate the Company’s ownership along the entire mineralized trend.

The data from the Phase I exploration program was obtained from a mineralized trend of approximately 12 km. Some of the exploration work was required to maintain the tenements in good legal standing with the Brazilian mining and exploration agencies. Because the assay results and drill holes were widely spread, the parameters for the for the resource estimate are conservative. Nevertheless, they included:

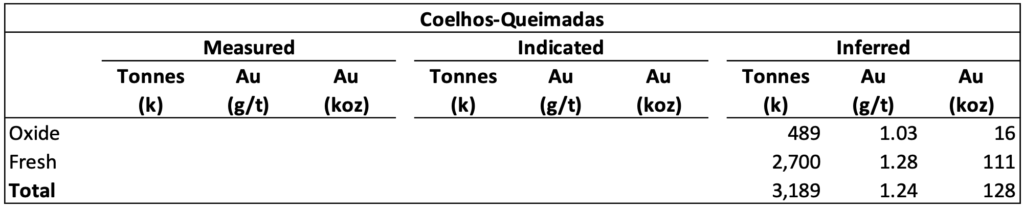

- Three block models over 39 mineralized bodies were prepared based on the targets of Coelhos-Queimadas, Mirador and Igrejinha

- A capping of 12 g/t Au was used to reduce the influence of outlier sample data

- A cut-off grade of 0.4 g/t Au

Resource Estimate

The mineral resource estimate is that material within the block models using a cut-off grade of 0.4 g/t Au. The effective date for the mineral resource is 16th of March, 2021 and a corresponding technical report disclosing the mineral resource estimate in accordance with NI 43-101 has been prepared by RBM Consultoria Mineral for the Company endorsed by Mr. Rodrigo Mello, FAusImm. Mr. Mello is also a QP as defined under NI 43-101. South Atlantic will file the technical report on SEDAR at www.sedar.com within 45 days of this news release.

Details of mineral resource by Target:

- Figures have been rounded to the appropriate level of precision for the reporting of mineral resources.

- All figures are in metric tonnes.

- Mineral Resources that are not Mineral Resources do not have demonstrated economic viability.

- The estimate of mineral resources may be materially affected by geology, environment, permitting, legal title, taxation, sociopolitical, marketing or other issues.

- Inferred Mineral Resources have been estimated in accordance with the definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) and incorporated in NI 43-101, “Standards of Disclosure for Mineral Projects” by Canadian securities regulatory authorities.

- An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological grade and continuity.

Phase II Exploration Program

A Phase II Exploration program is proposed for the 3 main targets that lie along the 12 km mineralized trend. The primary goal of Phase II is to focus on an in-fill drilling program, commencing with the 39 mineralized bodies that have been identified in the Phase I program. Figure 1 in the Annex illustrates the three main targets in the 12km mineralized extension including Igrejinha, Coelhos-Queimadas and Mirador and shows that some outlines of mineralized bodies are starting to take shape. Additionally, there are areas which due to limited time and budget in Phase I, have no exploration results. Phase II is designed to both explore those areas not covered in Phase I and to provide some along-strike extensions to these targets. Most of this work can be accomplished with trenching and RC drilling as was done in Phase I. Additionally, core drilling will be conducted to test potential mineralization at depths.

The Phase II exploration program will also enable the Company to maintain all tenements in good legal standing through completion of exploration work and filing of required reports to the Brazilian authorities. Over 23 targets and areas of interest at Pedra Branca have not been drilled or previously explored. These areas require some geochemical sampling and trenching to determine their continuing value over the 40 km mineralized trend of the Troia Greenstone Belt.

A technical 3-D video will soon be up on our website (www.southatlanticgold.com) to complement written descriptions of the Pedra Branca Project in press releases and on the website. This video not only puts into perspective the significant size of the Project, but also illustrates the infrastructure (power, good roads, commerce centers, and manpower), primary exploration targets (Coelho-Queimadas, Igrejinha and Mirador) and the potential upside and increase in mineral resources expected with the Phase II program combined with the remaining 43% of samples resulting from the Phase I program that was not included in this mineral resource estimate due to time constraints.

Other highlights of the Phase II program include:

- RC in-fill drilling will be focused on further delineation of the geology and mineralization of the gaps between the targets. RC drilling will also be conducted on the potential targets identified along the 30 km southern extension of the mineralized trend that did not receive any drilling during the Phase I exploration program.

- Diamond core drilling will be conducted to provide insight into lithology, structural geology, controls on mineralization, grades and grade variability at depth. Oriented core will be used to help in the understanding of the structural geology and controls of mineralization.

- Detailed 3D geologic and structural modeling.

- Mineral resource estimate to be updated to include the 8,188 additional assay results from the Phase I and additional samples from the Phase II exploration program .

- Trenching has been demonstrated to be a very efficient and cost-effective method to identify the sub-outcropped mineralized orebodies and will be the exploration technique to precede drilling in areas that were not explored in the Phase I program.

- Continuation of the community engagement program.

Quality Assurance / Quality Control

The Quality Assurance and Quality Control (QA/QC) protocol adopted by South Atlantic was comprised of a series of industry standard procedures designed to monitor the precision and repeatability of the reported assay results and identify potential problems at the laboratory. No drill hole from the project was sampled without a concomitant QA/QC program assuring the quality of the results. The QA/QC program developed by SAG has been inserted 4% of field Blanks, 4% field duplicates and 4% standards from Rocklabs and ITAK with range of 0.8 g/t to 8.0 g/t Au.

Qualified Person’s Statement

The Mineral Resource estimate was carried out by Mr. Rodrigo Mello, FAusIMM (number 209332), RBM Principal Geologists, serving as Independent Qualified Person, as defined in the CIM Definition Standards for mineral resources and Mineral Reserves in accordance with NI 43-101. Mr. Rodrigo is a geologist with 35 years’ experience in exploration and mineral project development, with relevant exposure to gold deposits in terrains like those found at the Pedra Branca Project. His working experience includes 15 years as an exploration geologist and project manager, working in Archean, Proterozoic and Tertiary environments, 20 years as a mineral resource analyst working in the evaluation of gold, copper, zinc, nickel and silver deposits in nine different countries, authoring or co-authoring 19 Technical Reports published on the Sedar database. Mr. Mello has reviewed and approved the scientific and technical information in this news release.

About South Atlantic Gold

South Atlantic Gold is an exploration company engaged in acquiring and advancing mineral properties located in the Americas. The Company’s principal BC asset is the wholly-owned 4,056-hectare Big Kidd property, located near Aspen Grove, BC. Our Brazilian flagship asset is our option to acquire the Pedra Branca project, located 280 km southwest of Fortaleza, Ceara State, Brazil. South Atlantic Gold is focused on creating value for its shareholders by engaging in the development and acquisition of high-quality mineral assets located in stable and mining friendly jurisdictions. South Atlantic Gold’s is based in Kelowna, British Columbia, and is listed on the TSX-V under the symbol “SAO.

ON BEHALF OF THE BOARD

Douglas Meirelles, President and CEO

For more information regarding this news release, please contact:

Anne Hite, Vice President, Investor Relations

T: 250-762-5777

Email: ir@southatlanticgold.com

Cautionary Note Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking Information”, as such term is used in applicable Canadian securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. There can be no assurance that the Fundamental Acquisition will be completed as proposed or at all.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company’s expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company’s public disclosure documents filed on the SEDAR website at www.sedar.com.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Annex

Figure 1 – Main Targets and Mineralized Trends at Pedra Branca

Figure 2 – Number of Samples and Mean Grade of the Modeled Ore Bodies